Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

When I started researching how to go about obtaining land, I vividly recalled staring at numbers that did not compute. How much would my payments actually be on a monthly basis? And this is precisely why the land payment calculator is your best buddy as you make wise financial choices.

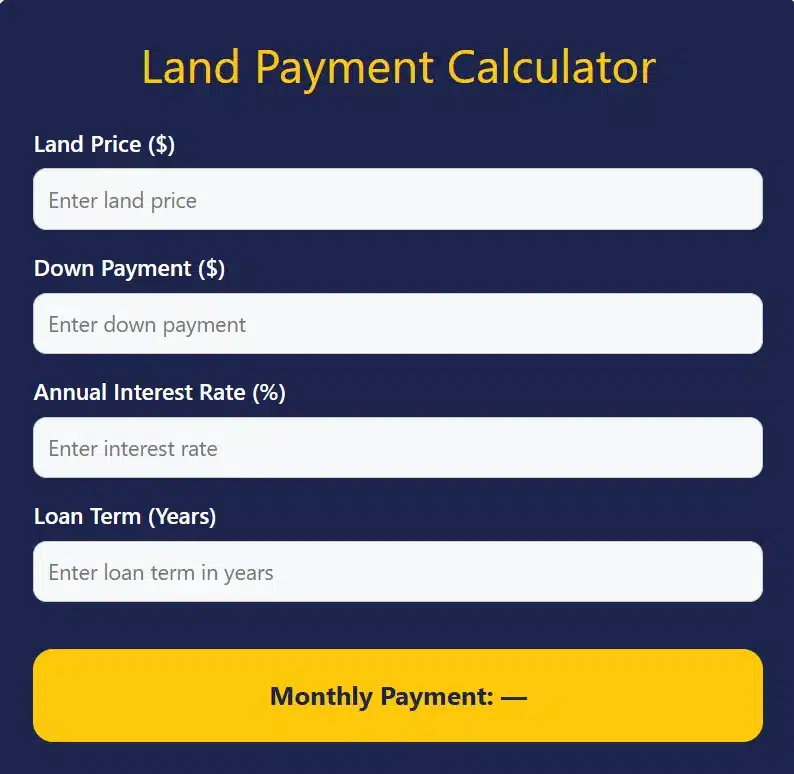

Land Payment Calculator

Important features of our Land Calculator

Our land payment calculator is powerful & doesn’t shy away from a challenge, it can deal with any situation you throw at it!

• Real-time estimated monthly payment amounts based on your loan’s interest rate, term and fees • Alternative down payment amounts to see how much money you can save over time by contributing more or making fewer payments upfront

• Change the interest rate to see what you could pay with other lenders • Adjust number of years on a loan – use a short term loan as long term financing & add in RevolverCredit details to compare your various options Where Amortization Calculator Plus Can Be Used: • Full amortization breakdown showing, principal and interest over time- Mobile friendly-ease for use You don’t need an internet connection -Amortization Calculator plus Works Offline! • No data plan needed, works offline without using your broadband data Limit Why is this important ı The calculator can work in areas without wifi signals or cell service.

How this Land Payment Calculator Works

It’s quick and easy to use our land payment calculator– I made it as simple as possible from feedback of actual users. Here’s your step-by-step guide:

Step 1: Enter Your Land Price Input the final price that you will be paying for this land deal. This is what should have been the sale price that both you and the seller agreed on.

Step 2: Include Your Down Payment Indicate how much you will be putting down. It’s worth remembering that a larger down payment often means lower monthly payments.

Step 3: Enter the Annual Interest Rate Add in the interest rate you’ve been offered by your lender. If you’re shopping around, experiment with different rates to test out your options.

Step 4: Select Your Loan Term Decide how many years you would like to use to finance the land. Loan lengths typically range from 5 to 30 years.

Step 5: Get Results Now hit the calculate button and watch your estimated monthly payment appear in the yellow results box.

Now imagine how lovely it would be to have this information before you head down to the bank?

When to Use This Land Loan Calculator

You might ask, “Why not just call my bank?” The catch is that you’re the one who has access to it and not your builder – which means you can play out scenarios before making any commitments.

Unlike simple calculators, our calculator will add a land cost factor. Many traditional mortgage calculators are not accurate for land contract payments. Interest rates on land loans are higher, while the terms are shorter, than on home mortgages.

I recall assisting a family friend whose jaw hit the floor after his bank gave him payments 40% higher than what he estimated with a standard mortgage calculator. That’s because land loans are considered riskier investments for lenders.

Our tool also allows you to play around with various scenarios on the fly. Would you like to see what an additional $10,000 down payment does to the monthly budget? Simply plug in a different number and recompute.

Use Cases: Who Can Use This Tool?

This plot cost calculator Pakistan and the global is for different people:

Newcomers to the land-buying process who want guidance on financing before they approach lenders. Sarah, a teacher in Lahore, used our calculator and found out she had to save for another six months before her dream plot became affordable.

Investors comparing various pieces of land. They can also do a fast analysis of what property is going to cashflow the best.

Contractors and construction professionals budgeting for project owners. Armed with the exact carrying costs, such firms compete on price for projects.

Advisers providing guidance to clients who would like to make educated decisions on land investment, with transparent payment breakdowns.

Current land owners who are wanting to refinance or buy more land.

My Experience with this Calculator

I had to go through some costly mistakes during my early years of investing in land as I was designing this calculator. I bought a plot in 2018 without doing the math for monthly expenses. I was barely making ends meet, so for two years those payments strained my budget.

And it was that experience that I learned to calculate land contract payments correctly. I did months of research when it came to land financing, spoke to those that lend on agricultural land and learned all about the nuances of vacant land loans.

The biggest shock to me, when it comes to land loan calculators and down payment comparisons is that often you will find if putting down 30-40% rather than only the minimum 20% can save you many thousands of dollars in total interest. This is the tool that takes those real-world insights into account.

The calculator has since helped me assess three other land purchases and, just as crucially, helped me walk away from deals that looked good on paper but would have crunched my finances.

Frequently Asked Questions

Q: How accurate are the calulator results?

The estimates give very good results using common amortisation formulae. But the terms you get will depend on your lender’s requirements and whether you have good credit.

Q: Can I use this for a farm property purchase?

Absolutely! The calculator is applicable to all land usage – household, business, farming or a playground. As long as you are using the right interest rate for your land type that is beautiful!

Q: Do the terms on land loans differ from those for home mortgages?

Yes, land loans are typically higher than mortgage rates (generally 1-3% more), and they also have shorter terms. 10 to 20 year mortgages are still offered by many lenders who do not favor the 30 year alternative.

Q. What would be a good down payment for land?

and most require 20-50% down on vacant land. The higher the amount you bring to closing, the more favorable your interest rate and monthly payment.

Q: How can I tell if the interest rate is fair?

Shop around with multiple lenders. Agricultural Lenders, Community Banks and Credit Unions Agricultural lenders, community banks and credit unions frequently offer competitive rates on financing land.

Q: Can I compute payments for owner-financed land transactions?

Yes! The benefits of owner financing can include flexible terms. Enter the seller’s proposed interest rate and payment schedule into the calculator.

Related Tools

Get the most from your land investment planning with these awesome helper calculators:

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!