Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Have you ever wondered the value of your car or equipment after years of use? I’ve been there, looking at depreciation tables and trying to work out residual values. That’s when a Salvage Value Calculator enters your financial life and saves it – calculate an asset’s final (residual) value after accounting for depreciation, wear and tear, accumulative use, surviving useful life or any other enabled depreciation method.

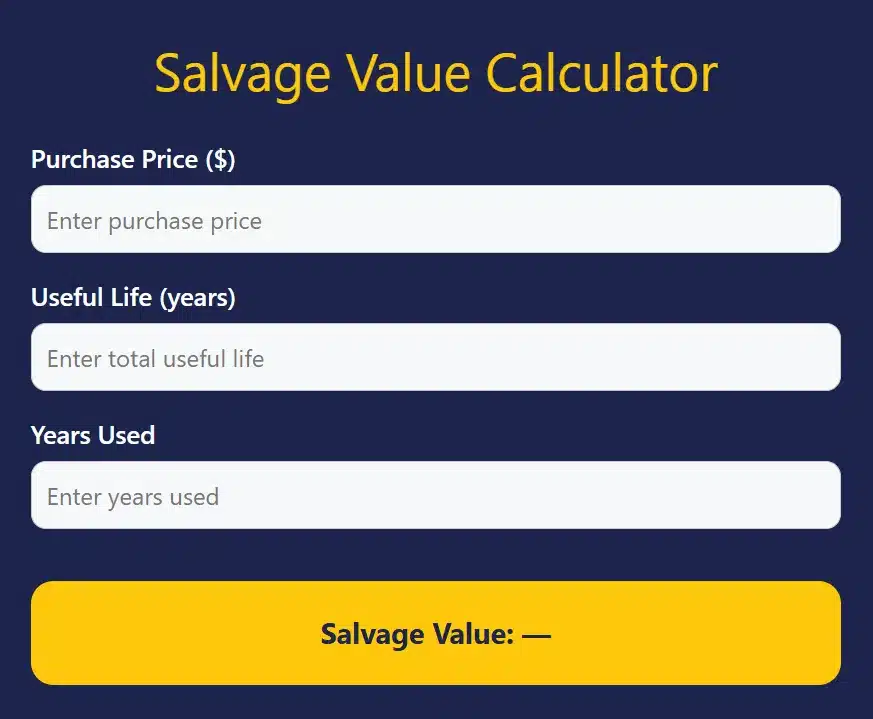

Salvage Value Calculator

Key Features

• Easy Data Entry – Just input cost, life, and years used • Instant Results – Accurate salvage values in seconds • Many Types of Assets Supported – Great for cars, trucks equipment & personal property • No math required – Performs all calculations needed • Smartphone Optimized Interface – compute anywhere you are with just your phone or tablet • Completely FREE to use – no credit card or user account necessary!

How to Use the Salvage Value Calculator

The application of this gadget is so easy to use that even my friend who is an accountant was blown away by. Here’s the step-by-step process:

Step 1: Enter the original “Purchase Price ($)” in the first input field (e.g., $25,000 for a car) Step 2: Input the “Useful Life (years)” – the total expected lifespan of your asset (e.g., 10 years) Step 3: Enter “Years Used” – how many years the asset has already been in service (e.g., 3 years) Step 4: Click the yellow “Salvage Value: —” button to calculate Step 5: The tool instantly displays your asset’s current salvage value

Now imagine this – no complicated depreciation method systems to calculate, no using the LiMAC formulas(arithmetic or geometric) and long calculations to find out salvage value formula. You receive answers in less than 30 seconds!

Why Do You Need a Salvage Value Calculator

You may be asking yourself, “How to calculate salvage value by hand?” Now, here’s the area in which our calculator is going to really stand out from conventional methods and other products.

Minimizes Math Errors: By manually adding straight line depreciation or double declining balance method, you are prone to errors. and I’d waste a ton of a time working through spreadsheets to find out the calculations didn’t add up!

Manages Depreciation in Complex Cases: No matter if you have an annual depreciation, yearly depreciation or accelerated depreciation, we know how to handle everything with the right formulas behind it.

Save Time and Get the Depreciation Calculation Results Now : Instead of Calculating depreciation amounts for each year, its a no brainer to get the instant results without spending time on it.

Professional-Quality Accuracy: The calculator applies standard accounting principles to salvage value calculator so you can rest assured your results are accurate when compared with professional liability assessments.

Use Cases: When This Calculator is Essential

The potential of salvage value calculator uses may surprise you. Here are some real-world examples of how people are using this tool on a daily basis:

Car Valuation: Car owners and dealerships utilize it to get the calculate salvage value car prices for insurance claims, trade-ins and plans. You should give it a try as well if you’re planning to sell your car!

Business Valuation: Businesses use depreciation on equipment to base decision-making for when an asset should be replaced, upgraded, or salvage planned for the fiscal tax year.

Insurance Evaluations: In total loss settlements, insurance adjusters use salvage value appraisals to determine whether their offer is in line with a fair price.

Financial Planning – Now, it’s used by people considering big ticket purchases to comprehend how and in what ways buying cost results itself in value over time and at selling.

Accounting and Taxation: Companies compute their amounts of depreciation expense, after tax salvage value for financial reporting and tax planning purposes.

Equipment Leasing: Companies how to calculate salvage value of a vehicle or machinery to set appropriate lease terms and residual value guarantees.

My Own Experience with This Calculator

I’ve been dealing with depreciation calculator for years, but this salvage value calculator has proven invaluable as it relates to my consulting business. A client only last month needed to determine the salvage value of a fleet of vehicles for insurance, and instead of days doing it manually, we got 50 cars done in under an hour.

It was as accurate as comparing it to what appraisers charge. Perhaps this will help lighten your load, too — particularly if you’ve got a bunch of assets to track or need rapid valuations to make decisions.

What I loved? How it smoothly accepted range debits for year with high level of depreciation to earlier years, or shorter useful life left over the number of years.

Understanding Salvage Value Calculations

How to calculate salvage value Knowing that physical assets deteriorate in value over time is key when computing how to find the salvage value. Salvage value depreciation formula usually roams: Salvage Value = Purchase Price – (Annual Depreciation × Years Used).

The true salvage value percentage, however, can differ depending on the asset class and whether we use market-based rates or straight line depreciation methods. Our calculator handles those inputs for you, eliminating having to do tricky years digits figures or declining balance depreciation.

Frequently Asked Questions (FAQs)

Q: How precise is this salvage value calculator?

A: The calculator takes its basis from accepted depreciation formulas and yields results which are parallel to the way claims have been settled in the industry, standard accounting practices, and u003cstrongu003evehicle salvage value calculatoru003c/strongu003e.

Q: Do you guys use this for salvaged title vehicles?

A: Yes! It is technically a u003cstrongu003esalvage title car value calculatoru003c/strongu003e that can be used to determine the fair market value for any damaged or rebuilt car.

Q: Will it work with all types of assets?

A: Absolutely. When it comes to vehicles, equipment or property, u003cstrongu003ehow to calculate salvage valueu003c/strongu003e principles apply equally across asset types.

Q: How can you determine the salvage value without depreciation?

A: You are correct, our calculator defaults to the straight-line method but you can override inputs and set it for your own u003cstrongu003edepreciation methodu003c/strongu003e needs.

Q: May I compute after-tax salvage values?

A: The calculator just gives you the gross salvage value – you can use that information to figure out u003cstrongu003ehow to calculate after tax salvage valueu003c/strongu003e, so long as your post-tax tax rates are known.

Q: Will this work for business accounting?

A:Yes, the solution is consistent with accounting u003cstrongu003edepreciation expenseu003c/strongu003e calculation described in standard and financial reporting demands.

Q: How frequently should I revise salvage values?

A: These are recalculated annually so you can keep your actual vs projected depreciation, and adjust the amounts of depreciation.

Related Tools

Supplement your financial planning with these additional calculators:

• Net Worth Calculator – Monitor all of your finances, including property and depreciation

• CD Interest Calculator – Investopedia: Calculate Returns On Fixed Income Investments

• Dave Ramsey Investment Calculator – Plan for the long haul with investment strategies.

The Salvage Value Calculator simplifies the complex calculations of depreciation into an easy to use and efficient value. Whether you’re a business owner calculating asset values, an individual planning upcoming vehicle purchases, or an accountant with clients asking for an easy-to-understand financial statement, this application will get high-quality figures without the complexity. There’s never been a better time to learn vehicle salvage value calculator – why not try it out for yourself today and save all that time on your next valuation job!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!