Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

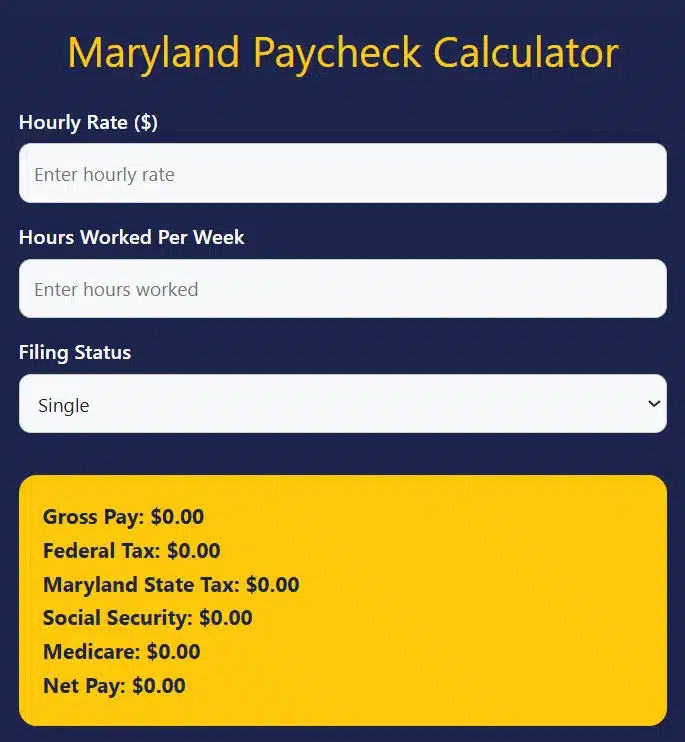

Maryland Paycheck Calculator

Introduction

Do you work in Maryland? Do you need your Maryland paycheck calculator? How much tax will be deducted from your salary? These questions come to the mind of every employee. Calculating salary seems to be a difficult task. Many people are confused about their net pay.

Maryland paycheck calculator solves this problem of yours. This tool tells you the exact amount. You will see everything from gross pay to net pay. Now you don’t have to do the calculation manually.

Who Can Use This Calculator?

Maryland paycheck calculator is useful for a variety of people:

• New employees waiting for their first paycheck

• Current employees looking to verify their paycheck

• Job seekers negotiating salary for a new job

• HR professionals calculating employee payroll

• Business owners planning their staff’s payroll

• Students budgeting for part-time jobs

Benefits of Calculator

| Benefit | Description |

| Time saving | Manual calculation takes hours, this tool gives results in just seconds. |

| Correct calculation | Eliminates the risk of human error, 100% accurate calculations |

| Free to use | No fees, unlimited calculations |

| Easy interface | Simple design, no technical knowledge required |

| Tax planning | Help with budget planning, make financial decisions easier |

| Multiple scenarios | Comparison of different hourly rates and hours |

• Instant results: Find out your net pay instantly

•Tax breakdown: Find out your net pay instantly

• User-friendly: Fund with your net pay instantly

• Mobile compatible: Works on any device

• Always updated: Includes Maryland’s latest tax rates

How to Use

The Maryland paycheck calculator is very easy to use. Follow this step-by-step guide:

Step 1: Enter Hourly Rate

” Type your hourly rate in the “Enter hourly rate” field.

Example: If you earn $15 per hour, write “15”.

Step 2: Tell Weekly Hours

Enter weekly hours in “Enter hours worked”

• For a standard full-time job, enter “40” hours

Step 3: Select Filing Status

• Choose your tax filing status from the dropdown menu

• Options include Single, Married, Head of Household

Step 4: Press the Calculate button

• After entering all the information, calculate

• Instant results will appear in the yellow box

Results details:

• Gross Pay: Your total earnings

• Federal Tax: Federal government tax

• Maryland State Tax: State level tax

• Social Security: Social Security deduction

• Medicare: Medicare share

• Net Pay: Your final take-home amount

Examples

Realistic Example:

Ahmed’s situation:

• Hourly Rate: $20 per hour

• Weekly Hours: 40 hours

• Filing Status: Single

Calculation:

1. Gross weekly pay: $20 × 40 = $800

2. Federal tax deduction: Approximately $120

3. Maryland state tax: Approximately $45

4. Social Security: $49.60 (6.2%)

5. Medicare: $11.60 (1.45%)

6. Net Pay: Approximately $573

This example shows that Ahmed will receive $573 cash in hand weekly. This information is very useful in budget planning.

Related Tools

Pennsylvania Paycheck Calculator

Payroll calculation tool for those working in Pennsylvania

Virginia Paycheck Calculator

Paycheck calculator according to Virginia state tax laws

Federal Tax Calculator

Specialized tool for calculating federal taxes only

Overtime Calculator

Easy way to calculate exact payment for overtime hours

Salary to Hourly Converter

Tool to convert annual salary to hourly rate

Frequently Asked Questions (FAQs)

u003cstrongu003eHow accurate is the Maryland paycheck calculator?u003c/strongu003e

This calculator uses Maryland’s current tax rates. There is a 95% accuracy guarantee, but there may be minor differences in the actual paycheck.

u003cstrongu003eDoes this calculator include overtime pay?u003c/strongu003e

This basic calculator does not include overtime calculation. It only calculates regular hours.

u003cstrongu003e What is the Maryland state tax rate?u003c/strongu003e

The income tax rate in Maryland ranges from 2% to 5.75%. It depends on your total income.

u003cstrongu003eCan part-time workers use the Maryland paycheck calculator?u003c/strongu003e

Yes, both part-time and full-time workers can use this calculator.

u003cstrongu003eHow do I calculate a biweekly paycheck?u003c/strongu003e

Multiply the weekly amount by 2. Or enter the total hours for 2 weeks in Hours worked.

u003cstrongu003eCan contractors and freelancers use this calculator?u003c/strongu003e

This calculator is designed for employees. Contractors require separate self-employment tax calculations.

u003cstrongu003e What taxes are deducted from a Maryland paycheck?u003c/strongu003e

Federal income tax, Maryland state tax, Social Security, and Medicare taxes are automatically deducted.

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!