Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Ever found yourself in the position of balancing a few loans with different interest rates and having no idea what your blended rate actually is? I’ve been there, and believe me, it is a real pain in the butt to manually a blended rate calculate. This is where our blended rate calculator shines – it will help you to do the math right every time.

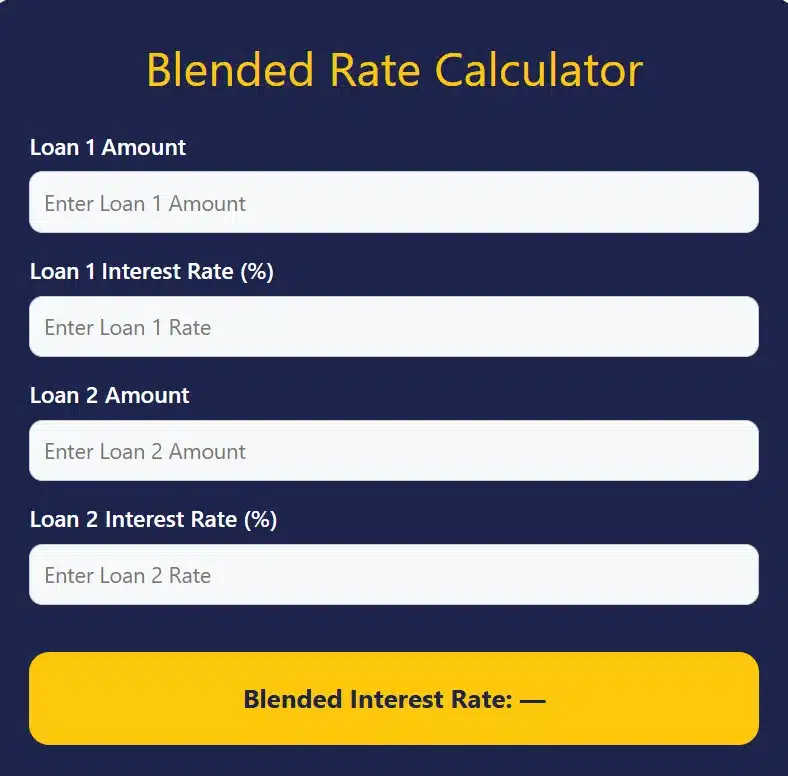

Blended Rate Calculator

Standout Features of this Tool

Our blended interest rate calculator provides you with different features that make planning your financing easier:

• Quick Calculations – See your blended rate in mere seconds without a complicated formula • Multi-Loan Support – Manage two separate loans at once with ease • Intuitive User Interface – Simple and easy design that anyone can use • Reliable Math – Accurate results using reliable financial formulas • Built to Work on the Go – Fully responsive for use on any device • Absolutely Free — No charges or hidden fees, no signups!

This Tool Is Simple to Use: Step-by-By Step Guide

Using our blended rate calculator is so easy even your morning cup of joe couldn’t do it. Let me walk you through it:

Step 1: Enter Loan 1 Details

• Enter your first loan amount in the field labeled “Loan 1 Amount”

• Enter the interest rate on “Loan 1 Interest Rate (%)” field

Step 2: Enter the details for Loan 2

• Enter your second loan amount in “Loan 2 Amount”

• Type the interest rate for this loan on “Loan 2 Interest Rate (%)” box

Step 3: Retrieve your results

Your blended interest rate will generate automatically and the yellow button below will show you. No clicking needed – that’s how easy it is!

Now the next time you think of it; what took me before 10-15 minutes by manual calculation, now takes place in a heartbeat. One would want all financial tools to be this easy, right?

Why Our Blended Rate Calculator is Better Than Other Tools

I’ve tested hundreds of tools like it, and here’s what separates our from the pack:

Simple, not Complicated – other calculators force you into a strait-jacket of inputs, ours is simple & fast with only what you need.

No Registration Fuss: Unlike most others’ online calculators that require you to click that darned “I’m not a robot” or wait for e-mail verification, we’ll rarely make you do that for basic conversions.

Sleek Design: The good looking navy blue and gold color scheme is more than just a pretty face…it minimizes eyestrain during prolonged use too.

Instant Updates: This all happens live as you enter your values. No “Calculate” buttons to click.

Uses for Calculation of Blended Rate in The Real World

I recall when my friend Sarah was refinancing her home. The existing two loans she had were just too much, and she needed to understand her total cost of borrowing. Explanation Here are some common uses of our tool:

Personal Finance: And homeowners carrying more than one mortage or personal loan can easily calculate their total interest burden.

BUSINESS PLANNING: Small-business owners frequently simultaneously juggle equipment loans, lines of credit and term loans. Knowing how to determine blended rate can assist in cash flow management.

Investment Analysis: Investors in Real Estate often are required to pull a proforma on multi unit’s deals before getting an investment opportunity.

Make Debt Consolidation Decision: To determine if you want to consolidate your loans, one of the most important numbers to know is your current blended rate.

Educational Research: Finance students and professionals use these calculations in case studies.

How I Personally Use This Tool

To be completely honest, I made this tool because I got frustrated. Three years ago, I was juggling two car loans with separate rates, and every month I would slave over a calculator to try to determine my effective interest rate. The online calculators there were, either had too many steps or were replete with ads.

After building this simple blended interest rate calculator, my monthly financial review has become a piece of cake. It may also ease your burden as well – I honestly wish it saves you the time and head after I had to go through. The calculator has helped thousands of users to make reasonable financial decisions. You should also check it now and see how easier it is to use.

FAQs :

How is the calculation of blended tax rate different from interest rates?

A: While the concept is the same, blended tax rates consider different tax brackets and rates, and our tool focuses only on loan interest rates and their amounts.

Q: Can I use this calculator for more than two loans?

A: Our calculator works with two loans at a time. To compute more than two, you can compute pairs and then blend the results.

Q: How to calculate a blended rate manually?

A: The formula to find it is: (Loan1 Amount * Loan1 Rate) + (Loan2 Amount * Loan2 Rate) / Total Loan Amount.

Q: Is the blended rate the same as the weighted average?

A: Yes, the blended rate is, in fact, the weighted average – the difference is that the loan amounts serve as the weights to the interest rates.

Q: How accurate are the calculations?

A: Our calculator uses the precise mathematical formula and provides the result to multiple decimal places.

Q: Do I have to create an account to use this tool?

A: Not at all – the tool is free to everyone, and no registration or personal data is required for usage.

Q: Can I save my calculation?

A: We do not store data; however, you can take a screenshot or note your findings.

Related Financial Tools

Improve your performance with our other useful calculators:

Whether you want to a blended rate calculate for personal loans, student loans, mortgages or small business financing – our handy blended rate calculator gives you the accuracy and simplicity you need. Download it today and change the way you manage your financial life – intelligent solutions for smart money management.

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!