Debt Payoff Calculator

Debt Payoff Calculator

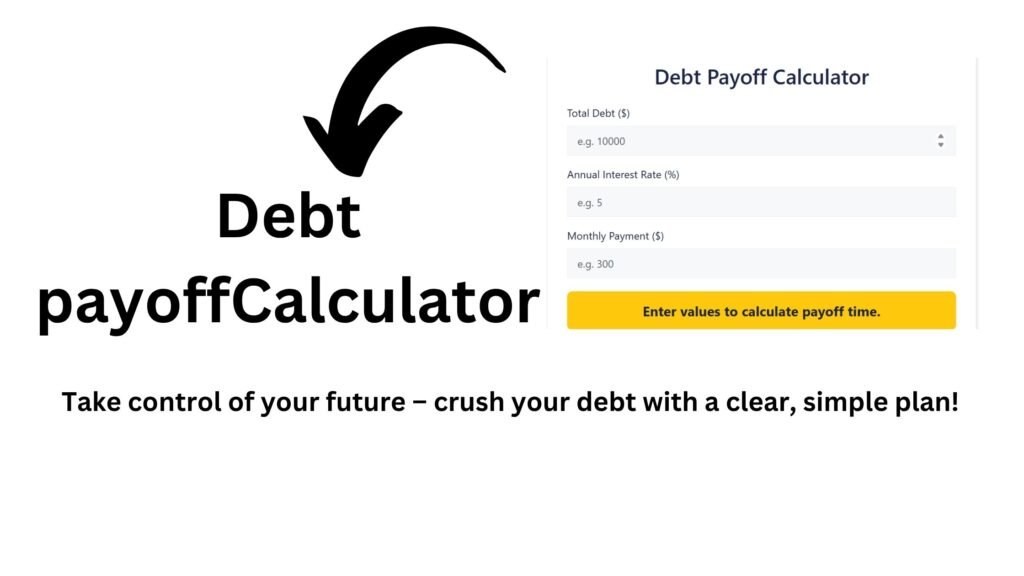

Take Control of Your Financial Future

Managing debt is a crucial step toward achieving financial freedom. A debt payoff calculator plays a vital role in helping individuals understand their financial obligations and create effective repayment strategies. Whether you deal with credit cards, student loans, or personal debts, using a calculator debt payoff tool provides a clear and structured path toward becoming debt-free.

What Is a Debt Payoff Calculator?

A debt payoff calculator helps individuals calculate how long it takes to pay off their debts based on the current balance, interest rates, and monthly payments. It gives a visual representation of the debt journey and outlines strategies to pay off debt faster. Many people are using debt calculator payoff tools to create a more efficient plan and minimize interest costs.

These calculators are becoming increasingly popular among those who want to stop living paycheck to paycheck and start building a stable financial future.

How Does a Debt Payoff Calculator Work?

A payoff debt calculator requires a few basic inputs:

- Current balance

- Interest rate

- Monthly payment amount

- Extra monthly payments (if any)

Once you enter these details, the credit card debt payoff calculator or student debt payoff calculator instantly displays a payment schedule. It shows how much time it takes to become debt-free and how much interest you save by paying more than the minimum.

Some users prefer using the debt payoff calculator excel version for more customization and control. Others rely on platforms like the debt payoff calculator Google Sheets, which provide flexibility and cloud access.

Types of Debt Payoff Calculators

Different types of calculators cater to various financial needs. Let’s look at the most popular ones:

1. Credit Card Debt Calculator Payoff

Many people struggle with high-interest credit cards. A credit card debt calculator payoff helps them understand how long it takes to pay off their cards and how much interest they accumulate over time. Using a credit debt payoff calculator regularly keeps users informed and motivated.

2. Student Debt Calculator Payoff

With rising tuition fees, student loans are a significant burden. A student loan debt payoff calculator or a student debt calculator payoff provides clarity on how to manage educational loans effectively.

3. Accelerated Debt Payoff Calculator

This calculator is ideal for those who want to pay off debt faster by making additional payments. The accelerated debt payoff calculator reveals how small extra payments make a big impact over time.

4. Snowball Debt Payoff Calculator

The snowball debt payoff calculator focuses on paying off the smallest debts first to build momentum. Many people use a debt payoff snowball calculator spreadsheet to track progress and stay on course.

Benefits of Using a Debt Payoff Calculator

Using a debt payoff calculator calculator gives you the following advantages:

- Clarity and Planning: It provides a roadmap and helps set realistic goals.

- Motivation: Watching your debt decrease month by month boosts confidence.

- Interest Savings: You can identify strategies to minimize interest.

- Informed Decisions: Tools like the cc debt payoff calculator and credit karma debt payoff calculator help make smarter financial choices.

Tools and Resources

You don’t need to be a financial expert to use these tools. Platforms such as Bankrate debt payoff calculator and credit karma debt payoff calculator offer user-friendly interfaces. For more advanced users, a debt payoff calculator Excel sheet or Google Sheets version provides granular control.

The best debt payoff calculator often includes multiple repayment methods, charts, and printable schedules. Users compare different tools to find one that fits their financial situation.

How to Calculate Debt Payoff

To calculate debt payoff, follow these steps:

- List all your debts, including the balance and interest rate.

- Choose a strategy (e.g., snowball or avalanche).

- Input your numbers into a calculator debt payoff tool.

- Review your results and plan accordingly.

- Track your progress weekly or monthly.

Using tools like the snowball debt payoff calculator or a debt payoff calculator spreadsheet keeps you disciplined and aware.

Why You Should Start Today

Financial freedom doesn’t happen overnight, but using a debt payoff calculator makes the journey easier and more structured. Whether you deal with student loans, credit cards, or personal loans, taking that first step today sets the stage for a debt-free tomorrow.

Remember, the sooner you start using a credit card debt payoff calculator or student loan debt payoff calculator, the sooner you reclaim control of your finances. Every dollar you put toward your debt today reduces interest tomorrow.