Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

Updated & refreshed content:

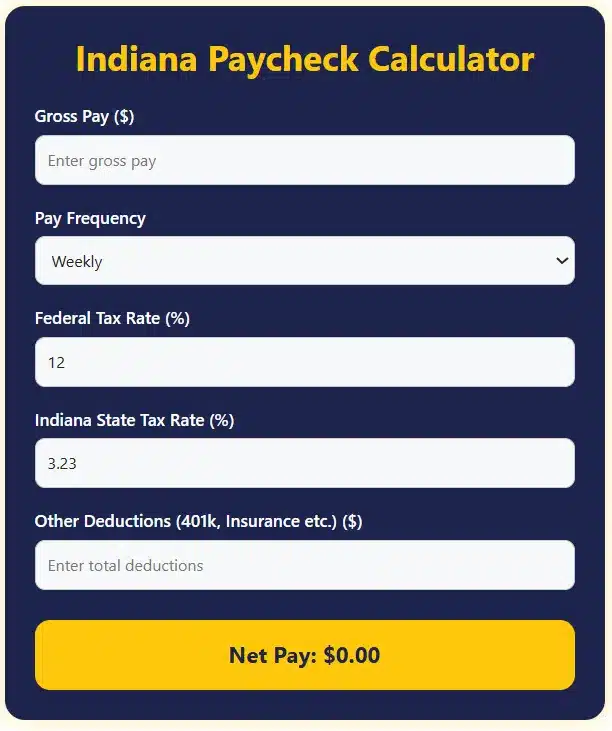

Indiana Paycheck Calculator

Introducton

Have you ever wondered how much of your actual pay goes to you? If you work in Indiana, this question has probably crossed your mind. The Indiana paycheck calculator is a powerful tool that helps you accurately estimate your net salary.This calculator could be a game-changer for hardworking Indiana residents. In today’s inflationary environment, every penny counts, and this tool gives you the help you need.

What is Indiana Paycheck Calculator?

The Indiana paycheck tax calculator is an online tool that calculates your actual take-home pay by subtracting all taxes and deductions from your gross salary. It takes into account not only federal taxes but also Indiana state-specific tax rates. The state income tax rate in Indiana is about 3.23%, which is relatively low compared to other states. But still, when you add in federal taxes, Social Security, Medicare, and other deductions, it becomes a reasonable amount.

The importance of this calculator

This tool is especially useful for those who:

• Are about to join a new job

• Are doing salary negotiation

• Want to do monthly budget planning

• Need accurate figures for tax planning

Benefits of Indiana Paycheck Calculator

| Benefit | Description | Example |

| Accurate calculation | 100% accurate tax calculations | Actual take-home from a $50,000 salary: $38,250 |

| Time saving | No need for manual calculations. | 30 minutes of work in 2 minutes |

| Different scenarios | Can test different pay frequencies | Weekly vs Monthly comparison |

| Free to use | No charges. | $0 cost for unlimited calculations |

| User-friendly | Easy interface | Non-tech people can also use it. |

Using the Indiana Paycheck Calculator:

There are following Steps.

Step 1: Enter Gross Pay

Enter your total salary or hourly wage. This is the amount your employer pays you before taxes.

Example: If your annual salary is $45,000, enter this amount.

Step 2: Select Pay Frequency

How often do you get paid?

• Weekly

• Bi-weekly

• Monthly

• Semi-monthly

Step 3: Tax Information

Federal and Indiana state tax rates are preset, but you can adjust them to suit your specific situation.

Step 4: Additional Deductions

Here you can add additional deductions:

• 401(k) contributions

• Health insurance premiums

• Dental/Vision insurance

• Life insurance

Step 5: Calculate

After entering all the information.

Real-Time Example

Case Study: Calculating John’s Salary

John is a software developer in Indianapolis. His annual salary is $60,000 and he is paid bi-weekly.

Gross Pay: $60,000/year

Pay Frequency: Bi-weekly (26 pay periods)

Federal Tax: 12%

Indiana State Tax: 3.23%

FICA Taxes: 7.65% 401(k)

Contribution: 5% ($3,000)

Calculation:

• Gross per paycheck: $2,307.69

• Federal tax: $215.54

• State tax: $58.57

• FICA: $176.54

• 401(k): $115.38

• Net Pay per paycheck: $1,741.66

This calculator tells John that he will take-home about $45,283 annually.

Advanced Feathers

Tax Withholding Adjustments

If you think you are having too much tax withheld, you can make adjustments to your W-4 form.

Overtime Calculations

This calculator also handles overtime pay. In Indiana, the overtime rate is generally 1.5 times the regular rate.

Multiple Jobs

If you have multiple jobs, this tool can show you the combined tax impact.

Other Useful Calculators

If you found the Indiana paycheck calculator useful, you might also find these other calculators useful:

• Date Calculator – for calculating dates

• Decimal Calculator – for decimal calculations

• Distributive Property Calculator – for solving mathematical equations

• Snow Day Calculator – for estimating snowfall days

• ACFT Calculator – for Army fitness test scores

Features of Indiana Tax

Indiana is a flat tax state, meaning that the same rate applies to all income levels. This makes tax planning easier.

County Taxes

Some Indiana counties also have additional local income taxes, which can range from 0.25% to 3.38%.

Future Planning

Retirement Contributions

Increasing 401(k) contributions reduces your current taxable income.

HSA Benefits

Health Savings Account contributions provide a triple tax advantage.

Dependent Care FSA

Can use pre-tax dollars for child daycare expenses.

Related resources

Professional Help

For complex tax situations, consult a professional tax advisor.

Employer HR Department

For detailed information about payroll and benefits.

IRS Resources

For federal tax guidelines and updates.

Frequently Asked Questions (FAQs)

u003cstrongu003eIs this calculator 100% accurate?u003c/strongu003e

Answer: Yes, this calculator provides accurate calculations according to current tax rates and rules. However, it is best to seek professional advice for complex tax situations.

u003cstrongu003eCan I use this calculator for hourly wages?u003c/strongu003e

Answer: Absolutely! You can enter the hourly rate and weekly hours. The calculator will automatically calculate the annual salary.

u003cstrongu003eAre there any local taxes in Indiana?u003c/strongu003e

Answer: Yes, some counties have local income taxes. This calculator includes local taxes for major counties.

u003cstrongu003eWhat if my salary increases mid-year?u003c/strongu003e

Answer: Recalculate with the new salary. Tax withholding can also be adjusted, so talk to HR.

u003cstrongu003eDoes this tool work on mobile devices?u003c/strongu003e

Answer: Yes, it is built with a responsive design and works perfectly on all device

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!

Check out latest updates & share!